Teachers work hard all year round, so why can’t we splurge on them with a well deserved treat?

Sadly we must discuss the policy regarding gift giving for teachers.

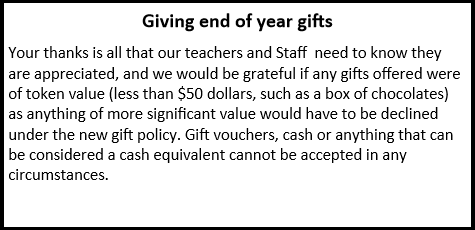

A note in our school newsletter advised parents that teachers gifts should only be of token value (under $50) or it cannot be accepted in any circumstances.

NSW teachers gift Policy

The policy for NSW teachers which states:

“Accepting gifts and other benefits has the potential to compromise your position by creating a sense of obligation and undermining your impartiality. It may also affect the reputation of the Department and its officers. You must not create the impression that any person or organisation is influencing the Department or the decisions of any of its employees.

“Always consider the value and purpose of a gift or benefit before making any decision about accepting it. A gift that is more than nominal value ($50) must not become personal property. You should either politely refuse it or advise the contributor that you will accept it on behalf of your school or workplace.

“When such a gift is accepted, you must advise your manager or Principal. They will determine how it should be treated and make a record of its receipt. Depending on the nature and value of the gift, it may be appropriate to record the gift in the asset register as a donation or other such record established for that purpose.”

Victoria teachers gift policy

OFFERS OF GIFTS, BENEFITS AND HOSPITALITY TYPES OF OFFER via VIC Education

“A Token offer is an offer of a gift, benefit or hospitality with an estimated or actual value that is less than $50, other than for a Gift of Appreciation (Teaching Service only). Refer to Definitions for further information about Token offers.

“A Non-Token offer is an offer of a gift, benefit or hospitality with an estimated or actual value that is $50 or more, other than for a Gift of Appreciation (Teaching Service only).

“A Gift of Appreciation is an offer from or on behalf of a parent, carer or student(s) made to members of the Teaching Service (only), intended to express appreciation of the teacher’s contribution to the education of a student or students.

“Where the estimated value is $100 or less, the Gift of Appreciation is considered Token and does not need to be declared. A gift with an estimated or actual value above $100 is considered Non-Token and must be declared. For further information see Gifts of Appreciation below.

GIFTS OF APPRECIATION

“Gifts of Appreciation may be provided by an individual or group of students, parents or carers. It is the total value of the offer rather than the individual contribution by each donor that determines if the offer is Non-Token.

“Gifts or benefits offered to a member of the Teaching Service by other members of the community (e.g. community groups, businesses) are not Gifts of Appreciation and are subject to the standard Token offer threshold of $50.

“Gifts received by a member of the Teaching Service that are valued above $100 are Non-Token gifts. Personnel must declare and seek approval to retain Non-Token gifts in the

“Registry system. These gifts have a unique legitimate business benefit: “conveying appreciation to members of the Teaching Service”.

“Non-Cash Vouchers as defined in this Policy and offered as Gifts of Appreciation may be accepted.

“Where the total estimated value of a Gift of Appreciation is equal to or exceeds $500, the Authorised Delegate has discretion to allow the Recipient to retain it only when it has been offered by multiple students, parents and/or carers. Otherwise, the Gift of Appreciation must be either declined or transferred to the ownership of the school or the Department.”

Department of Education TAS policy:

Officers and employees should not expect to receive gifts, benefits or hospitality for doing a job they are paid by the public to do. In most situations, ‘thanks’ is enough.

You must never accept a gift, benefit or hospitality, token memento or modest refreshment in the following circumstances:

• It is money or money equivalent;

• A valuable object valued at $100 AUD or higher;

• You are a Government buyer and your acceptance may influence or be perceived to influence a procurement or disposal decision;

• You or your agency makes decisions or gives advice regarding the gift giver or are likely to in future and your acceptance may influence or be perceived to influence the decision or advice;

• Your acceptance may otherwise cause an actual, perceived or potential conflict of interest, or may be seen by other people as a reward or incentive.

Officers and employees should not expect to receive gifts, benefits or hospitality for doing a job they are paid by the public to do. In most situations, officers and employees should refuse gifts, benefits or hospitality if offered.

However, in limited circumstances, it may be appropriate to consider acceptance of a gift, benefit or hospitality , or a modest refreshment, if offered.

On discussion with my school it became very clear that it is not even possible for parents to combine their dollars and purchase a gift together.

We recommend you check with your school what their policy is before going too crazy on a gift this year.

Has your school cracked down on what you can gift teachers?

Do you splurge on your child’s teacher? Or just give them a little token gift?

Share your comments below.

We may get commissions for purchases made using links in this post. Learn more.

8:12 pm

8:54 am

9:22 pm

8:48 am

12:04 pm

4:54 pm

11:46 am

8:25 am

10:02 pm

12:17 pm

6:39 am

4:56 pm

3:46 pm

5:24 am

-

-

-

-

mom207052 replied

- 06 Jan 2021 , 11:25 am

Reply5:54 pm

- 1

- 2

- …

- 8

- »

Post a comment